Selling Dual Eligible Special Needs Plans might seem “too complicated.” However, a little information can go a long way in developing a better understanding of these comprehensive plans.

We’re laying to rest some common myths about D-SNP sales so you can learn how to best position these specific plans in your Medicare portfolio.

What Is a D-SNP?

A Medicare Advantage Dual Eligible Special Needs Plan (D-SNP) is a special type of Medicare Advantage (MA) plan only available for Medicare recipients who are also eligible for their state’s Medicaid assistance.

These plans offer the extra benefits of both Medicare and Medicaid. Together, they create a well-rounded form of health insurance for those who need it the most. These beneficiaries are typically:

- Low income

- Disabled

- A combination of both

- Less likely to be over 65 years of age, since age isn’t a requirement

Unlike with traditional MA plans, dual-eligible individuals can utilize more D-SNP enrollment periods. When they first become eligible, they qualify for a Special Enrollment Period (SEP). It lasts from the time they become eligible to the time they enroll in the D-SNP.

Additionally, enrollees can potentially switch their plan choice once every month through the new integrated-care SEP. Whether they have access to this SEP depends on the state where they live, their Medicaid status, and the type of D-SNP.

Year-round enrollment opportunities make selling D-SNPs a viable option to boost sales during the non-AEP lock-in season.

Looking for more info on selling D-SNPs? Download our free eBook today!

Common Medicare Myths About Selling D-SNPs

Let’s review and bust some of the common misconceptions about selling D-SNPs.

Myth #1: Finding Dual-Eligible Clients Is Hard

You have a great opportunity to expand your networking radius and diversify your marketing tactics by targeting ads in certain areas where D-SNP clients are more likely to live.

It’s no secret that dual-eligible beneficiaries are either at a lower income level or more disabled than most recipients.

However, these clients can really live and travel anywhere. It’s best to use both traditional and digital marketing techniques to attract prospects.

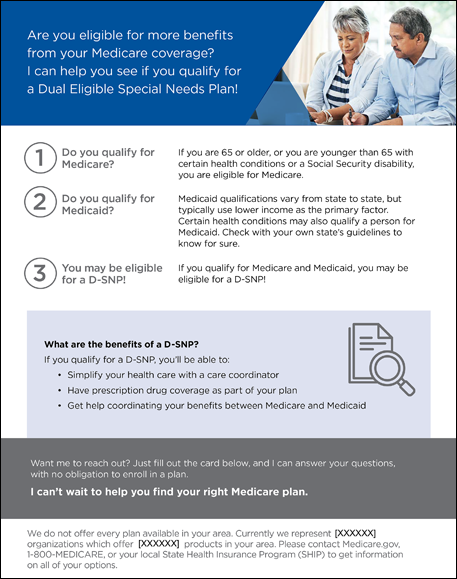

Use Integrity’s D-SNP Client Eligibility Letter to identify clients that could be eligible for D-SNP benefits! Additionally, distribute Integrity’s doctors, providers, and prescription drugs checklist to notify clients of the benefits they could be eligible for!

By positioning yourself as a resource within the community where D-SNP clients reside, perhaps that’s even your own community. You can be a trusted leader for dual-eligible individuals, and others, to help them secure the health care coverage they need.

You can be a trusted leader for dual-eligible individuals, and others, to help them secure the health care coverage they need.

There is, however, a stigma surrounding selling to dual-eligible individuals. That brings us to our next myth.

Myth #2: D-SNP Clients Are Challenging to Work With

This stereotype is one that we’d like to squash sooner rather than later. Mainly because it’s harmful to both clients and agents alike.

Associating low-income housing or certain areas of your town or city as being “unsafe” can be harmful to communities who may need the most help from agents like yourself!

Don’t allow misconceptions to prevent you from making new connections and perhaps even increasing your sales. We encourage you to always use your best judgment. But, don’t let someone else’s opinion stop you from fully doing your job to the best of your ability!

We encourage you to always use your best judgment. But, don’t let someone else’s opinion stop you from fully doing your job to the best of your ability.

There’s also the assumption that D-SNP enrollees are “too” disabled to work with. Frankly, that’s just not the case. However, there’s certainly a higher chance of encountering clients who need extra attention and care from their insurance agent.

This ensures they aren’t being unfairly taken advantage of at the expense of their disability.

Myth #3: The D-SNP Market Is Too Small to Pursue

As has been the case for many years, the number of dual-eligible individuals far outpaces those who are actually enrolled in a D-SNP. What that means is that there are people out there who could be in a D-SNP but aren’t! In fact, KFF reports that more than 80 percent of SNP enrollment is in plans designed for D-SNP!

With Medicare enrollment only projected to grow over the next decade, the number of dual-eligible individuals is likely poised to increase as well.

By not pursuing the D-SNP market, you’re quite literally shutting yourself off to a large portion of the potential sales market. This is especially true if you live in or near an area where dual-eligible clients live.

By not pursuing the D-SNP market, you’re quite literally shutting yourself off to a large portion of the potential sales market.

Some clients might not even realize their dual-eligibility status. As their insurance agent you should always double-check someone’s Medicaid status when enrolling them in a new plan!

Myth #4: My Clients Will Leave After One or Two Months

Part of the excitement of selling D-SNP plans is the potential for clients in certain states to enroll or change plans every month. This gives you the opportunity to gain new customers all year long, even outside of AEP!

Additionally, you’re given the opportunity to form close bonds with these clients. You can check on them throughout the year to update their plans or ensure they’re satisfied with the coverage you’ve already sold them!

It’s true… your clients could decide to disenroll from their plan shortly after signing up. Or, arguably worse, your client could fall into the hands of another insurance agent. If you are a reputable, customer-service oriented insurance agent who your clients can trust, we think the chances are certainly low!

You’ll get out what you put in with D-SNP sales, as you would with selling any type of plan. This gives you an opportunity to increase the quantity of your sales and the quality of each client interaction as well.

We hope you’ll see the benefits of selling these vital and comprehensive D-SNP plans in your community. By selling them, you can increase your sales opportunities and become an important figure for those in your area who need your help.

Toss your hat into the D-SNP market and start diversifying your portfolio. Register with Ritter for free to unlock sales technology, client communication capabilities, promotional materials, sales support, and more to help you on your way!

Not affiliated with or endorsed by Medicare or any government agency.

Share Post